FAST Money Management Program

Learn how to take control of your money

Why you need to get started now

The decisions you make today to buy things, borrow and save money will have a ripple effect on your finances for the rest of your life.

You need to know the impact of those decision today.

90% of women will need to be 100% responsible for their finances at some point in their lives. Whether that’s because of divorce or the fact that women on average out live men by 5 years, you can’t wait until you are a senior to know how it all works.

Your are either in, or entering your prime earning years. You need to maximize the outcome of these years to ensure the type of retirement you want to achieve.

Hey I’m Linda

I’m a finance coach and all around number nerd with an unshakable belief that we all deserve to be financially secure. I want to inspire you to be stronger, more confident, and at peace with your money.

I’m really proud of what you are going to find here at Real Family Finance. Everything I’m creating is about teaching you what you need to know about money.

Don’t know where to start? I got you.

Been trying all kinds of things that aren’t working? I’ll show you how to get on track.

Been working on your finances awhile but would like some affirmation you are on track? I’ll shout your success from the roof tops (only if you want me to).

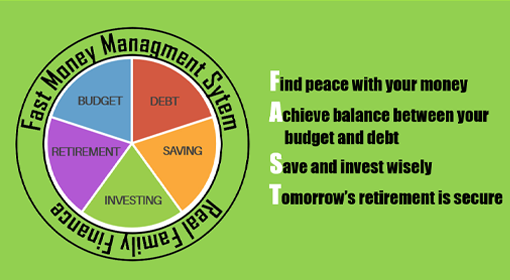

I’ve pulled it all together in my FAST Money Management Program. It will help you not only understand your money, but also show you how to dream big and put together an action plan that’s realistic and achievable.

I want you to imagine what your life would be like if you had your personal finances under control.

- Know you will never run out of money

- Know what to do when the inevitable crisis occurs and being able to not blow up your long-term plans to get the situation under control

- Live a lifestyle that makes you comfortable and happy, confident that you can afford your home, your car, and the things you make your life complete

- Know what your life will look like in retirement

- Not stress about paying bills because you know you how they fit into your long term financial plan.

There are challenges to learning to manage your money

- A recent survey by Prudential showed that only 20% of women felt they could manage money and only 14% thought they were on track to have enough for retirement.

- Personal finance has a lot of moving parts. There is budgeting, debt management, investing, saving, insurance and many more. Most are multi billion dollar industries that have products and services they want you to buy. Yet we are never taught how they work or how they all fit together.

- There are real challenges to getting started

- Where do you start?

- Who do you go to?

- Who do you trust?

- Where do you find the time?

- How do you overcome the fear?

- It’s incredibly stressful

- I’m embarrassed and don’t want to sit in a room full of other people to figure this out.

The fastest, easiest way to overcome these challenges is to make the leap into my FAST Money Management Program.

The leap can work for you if you feel:

Worried or Scared

Do you worry about how much money you owe?

Are you scared you won’t have enough money to retire when you want to?

Do you know people in retirement that are in dire financial situations and you worry that will be you one day?

Stressed

When you get an unexpected bill does your stomach knot?

Do you dread looking at your bank or credit card statements because you are afraid of what you will see?

Are you buying things you are afraid you can’t really afford?

Ready

Are you ready to let go of the worry, fear and stress?

Are you ready to find out how this all works and put a plan in place to make sure you are financially secure for the rest of your life?

Are you ready to take control and find peace with the money in your life?

The FAST Money Management Program

- The course is a total of seven modules that will be sent to you over eight weeks (there’s a catch up week in the middle)

- The course is self-paced so you can do the work when it’s convenient. You can also go back and re-watch lectures anytime you need to.

- There is a total of 5 hour of video classes.

- There will be weekly live calls where I will review the weekly content and answer questions.

The Modules

Getting Started

How do all the pieces fit together and how to create a personal financial plan that never runs out of money

- Why you can’t think about budgets, savings, debt, retirement and investing as stand alone things.

- Why you need to figure this out.

- What’s your emotional relationship with money?

- Get confident about what managing your money really means

Net Worth

Measure your wealth (also known as Net Worth). It’s the key to your plan’s success.

- What is net worth?

- Why you need to track how wealthy you are

- Create your own net worth and wealth tracker

- Experience the joy of knowing your true worth (it may surprise you!)

Budgeting

Control your money. Where does it come from and where does it go.

- What is a budget?

- Understanding the components you need to track.

- What components apply to you?

- Look at your own budget using one of three paths

- Wicked simple – it’s not about the numbers, it’s about the concept

- Ballpark – make some educated guesses

- Digging deep – using technology to know exactly what’s going on

- Start feeling like you are in control of your money

Retirement

Visualize your dream retirement, the ultimate goal…and see what it will cost.

- Create a vision of your life in retirement

- How you can use what you know now about your life and spending habits to project what it will cost when you retire.

- How to think about inflation, taxes and medical expenses when you retire.

- Build your own retirement budget

- Feel confident your retirement will be secure.

Savings

Learn how to set realistic savings goals and then crush them

- What should YOU being saving for?

- Compounding…the secret to your success

- How fast can you reach your goals

- Hiring a personal financial advisor

- Investing your first dollar

- Start seeing your bank account grow today

Debt Management

Learn how to conquer your debt once and for all.

- 5 Simple rules for managing debt

- Create a debt payoff plan that works

- Fifteen ways to get your debt under control

- Feel confident that whenever you need debt you’ll be able to easily integrate it into your financial plan

Launch

Take all the pieces, net worth, budgeting, retirement, saving and investing and debt management and pull it all together into one, personal plan.

- Learn how to pull all the pieces together into one, integrated plan

- Turn it into monthly, actionable tasks.

- Feel confident you now have a plan for your finanical success

Are you ready to get started?

$49.00 One-time Charge

Enrollment is currently closed but should open in February 2025. Sign up below to be notified when it opens.

But Wait! There’s More!

There are a few other things that I know you will find helpful during this process, so I’m including the following Bonuses!

Four Real World Money Challenges You Can Win

Rethink how you make decisions about spending money.

- Understand the true cost of buying that jetski

- How much credit card interest are you REALLY paying

- Should you use your 401k to pay off debt?

- A 15 or 30 year mortgage, which should you choose?

How your Spending Will Change Over Time

Where you are in life is going to affect how you think about spending money, saving and managing your debt. Where are you and where should you expect to be?

You can get the total program today for just

$49

Get Started!

Enrollment is currently closed but should open in February 2025. Sign up below to be notified when it opens.

Frequently Asked Questions

What if I want to Cancel?

If for ANY reason you want to cancel in the first 30 days, send us an email and we will refund you, no questions asked.

What if I fall behind?

This course can be completed at your own pace. I’ve built in plenty of time to get the work done, but if you need to catch up, you can do it at your own pace.

What if I miss a Q&A call

Each call is recorded so if you are unable to attend live, you can go back and hear it later.

I’m a private person. How can I participate in the Q&A calls without people knowing my business?

You can send your questions in advance and I will answer without revealing your name.

I’m not good with math. Will that prevent me from understanding the material?

Absolutely not. A lot of what we are teaching is concepts, not math. In fact, there are places in the course I will encourage you to listen along to get the concepts and go back to tackle the math later if you want. The places there are math, it won’t be more than adding, subtracting, multiplying a couple of times and dividing once.

What software/equipment will I need?

You can watch the videos on a smartphone, tablet or computer. There are only two documents you will work in. One is a pdf that you can print out. The second is a worksheet that you can do either in Excel or Google Docs. You will need access to a computer to do the worksheet.